A couple of random thoughts

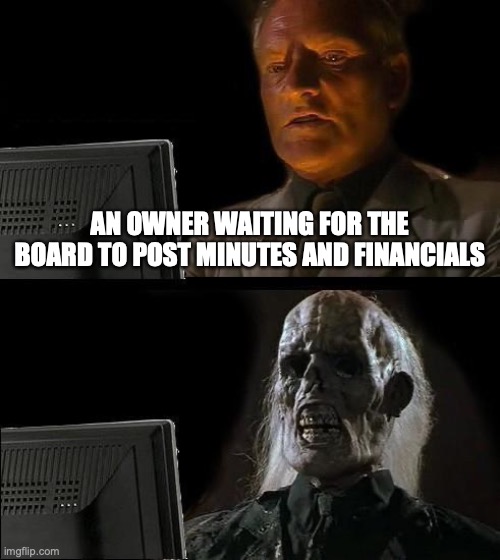

It's raining out and I thought it would be a good time to read the minutes from the June and July Board meetings. Oops! Neither is posted. Apparently the Board didn't see a need to hold its August meeting, so they wouldn't have had a chance to approve the July minutes. No word on why the June minutes are missing in action.

The June 30 financials have recently been posted. Just for fun, I looked up Exxon and Apple and both of them report earnings within 30 days after the end of the quarter. Who knew we were so much more complicated? I'll comment on the financials below.

I was curious about the Board minutes because the Board had apparently found that their duties of care and loyalty required them to trade a marsh lot for a pretty horrible lot. I was hoping to learn why giving an owner a lot that is probably worth over $250,000 in exchange for a lot that is clearly worth much less is in the best interest of the 570-odd owners of the Club. I guess I'll have to wait to find out! But I probably won't be smart enough to understand their explanation. Keep in mind that this is the same crew that's negotiating the seawall dispute.

I see nothing in the financials to be concerned about. The cash balances are about $5.7 million higher than they were on December 31, 2021, and about $8.2 million higher than they were on June 30, 2021. We received about $2 million in capital contributions (i.e., the transfer fee or the tax on departing owners), the operating fund is about $2 million higher than at year end and the replacement reserve is about $1 million higher than at year end. It looks like we've spend about $1.5 million on the amenities project so far.

Oddly, however, our operating fund and replacement reserve cash balances are about $2.5 million lower than they were a year ago. Not sure why that is, but it looks like our operating loss was about $700,000 higher in the first half of 2022 and we had an $800,000 gift from the government in 2021. In addition, the operating and replacement reserve assessments increased by about $500,000 during the first six months (575 members at $1,760 per member per year). Maybe there are other factors that aren't clear from the financials.

Comments

Post a Comment