Things the Board does--and things it doesn't

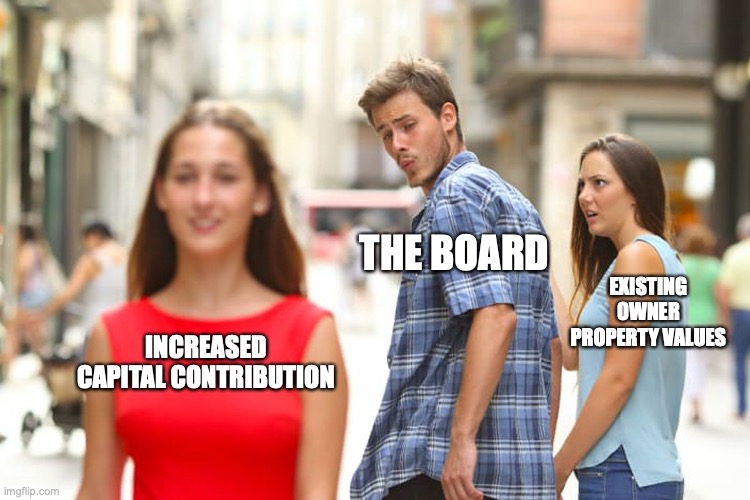

Lots of excitement following the Board's meeting on September 22. The headline news is that the "capital contribution" (also known as the "transfer fee" or "initiation fee" or "tax on selling homeowners") will increase to $90,000.

Lots of excitement following the Board's meeting on September 22. The headline news is that the "capital contribution" (also known as the "transfer fee" or "initiation fee" or "tax on selling homeowners") will increase to $90,000.

Let's go back to basics. There are four ways the Club can enhance its finances: (1) operate more efficiently (i.e., earn a profit from operations); (2) increase dues (either the annual operating and replacement reserve assessments) or a special assessment--like the recent $20,000 assessment for amenities; (3) increase the "capital contribution"; or (4) sell assets.

Historically, Colleton River has financed itself by increasing dues faster than inflation and by special assessments (nearly $50,000 per Owner since 2005). No sign of operating efficiencies and the Club has sold almost all of the Goodwin river and marsh lots.

As you can see in the graph above, exceeding inflation year-after-year adds up to a significant charge. But the Board has decided to use the "capital contribution" as a means to create a slush fund of money. The "capital contribution" is ostensibly imposed on new Owners. But who actually pays? Let's do a thought experiment. The seller and buyer have negotiated a deal where the buyer pays a $60,000 "capital contribution" and $1,500,000 for a house. On the eve of closing, the capital contribution increases to $90,000. What do you think happens?

1. The Buyer says "no problem" and pays the extra $30,000.

2. The Buyer says "too bad for you" and informs the seller that the new sales price is $1,470,000.

If you chose #2, you're in the company of the vast majority of financial analysts and economists. The buyer may write the check, but he's doing so with the seller's money. How do I know this? The buyer agreed to pay a total of $1,560,000 for the house. The Board increasing the capital contribution by $30,000 does nothing to benefit the buyer (actually, he benefits by about 1/575 of the $30,000--but that's close enough to zero for government work. If the house was worth $1,560,000 yesterday, it's worth $1,560,000 today. Otherwise you'd have to believe that the Club can increase our market values by simply charging a higher capital contribution. If that's the case, why stop at $90,000? Why not $200,000? The Board seems to begrudgingly recognize this by deferring the increase until November--ought to be interesting to see how many transactions "beat the clock."

I note that the number of sales transactions was down by about 1/3 during the first eight months of 2022. Jacking up the "capital contribution" is a way to keep "capital contribution" revenue up as sales transactions go down due to the Biden recession, the Biden bear market, and Biden's high mortgage rates.

Let me be clear. Raising the capital contribution is a perfectly legitimate way of raising money. The question is whether it's fair. Simply put, an increase in the capital contribution is not--as the Board claims-- "effectively an initiation fee." Rather, it is a tax on selling homeowners--regardless of who writes the check. So the one person who will not benefit from the $90,000 is the one bearing its burden. Remember, we're all sellers at some point. Wouldn't it be simpler to just increase the operating assessment and replacement reserve assessment to the point where we can pay our bills? But that would be a clear and open method to raise money and the Owners may notice and hold the Board accountable.

It's quite difficult to tell whether the amenities are on time and on budget and will come in for only 33% more than the originally promised cost. The Board doesn't provide coherent metrics on the progress of the amenities. But increasing the capital contribution will create a slush fund that will enable future amenity project overruns to be paid for "without another assessment."

The Board also recommended that Wandell be held over by popular demand. Oh well, he can't be any worse than most of the other Board members. But let's review his record:

2020: Chair of amenities committee. Outline developed, but no plans that could be accurately priced.

2021: Chair of governance committee. Major power grab by the Board--at least two provisions probably illegal ("code of conduct" and eliminating Board members' rights to review compensation information).

2022: President. Amenities re-voted with significant price increase. Construction started over a year late.

What didn't the Board do?

Still no word on the sweetheart deal given to an owner by trading a bad lot for a marsh lot at an opportunity cost to the Owners probably in excess of $250,000. Wonder why they aren't explaining this related party transaction? If it's such a good deal for the Club, one would expect them to be putting it on the front page.

No update on the seawall. Some background on the seawall litigation is here and here. The docket for the seawall lawsuit is available online. The short story is that 12 seawall lot owners filed suit against the Club for millions of dollars of damages. Litigation--as is usually the case--has been proceeding at a slow pace. The plaintiffs filed a "motion to compel" on August 29 because the Club has not timely responded to the Plaintiffs' discovery requests. While judges here may be different, judges in Maryland absolutely HATE discovery disputes. The rules set forth time limits and the Club had not responded to discovery requests dated May 27 by August 29 (when the motion to compel was filed). Why is the Club dragging its feet? Has the Club issued discovery to the Plaintiffs? The Club has the right to ask questions, demand documents, and conduct depositions. Has it done so? Generally speaking, the side with the more economic power and better case pushes discovery along. What are we waiting for? Just a reminder that the seawall may be worth $15 million--every Owner ought to care about this argument over who pays for repair and replacement.

If there are two things this Board's good at, it's raising prices and acting in the dark. Mission accomplished. The rest of us would be better served if the Board was more candid and timely in its communications about issues that are important to all of us.

Chad, I concur with all the above. Any idea how we can be assured that this Sea Wall issue doesn't result in members (non-sea wall members) either being dunned directly or indirectly via the Board using our money (capital contributions) to pay for this mess. How about accountability?

ReplyDeleteThe covenants clearly empower the Board to settle litigation. But any settlement that requires the payment of money out ion the capital fund that exceeds about $300,000 requires Owner approval. The risk I see is that the Board agrees to a settlement that shifts the cost of replacement of the 85% of the seawall not owned by the Club from the seawall lot owners to the Club. A hurricane hits and the Club could be on the hook for millions of dollars. Please bear in mind that the replacement cost of the entire seawall is at least $10 million and may be significantly higher. This isn't a trivial risk to either the seawall lo owners or the Club.

DeleteHere's what a member can do; (1) become informed about the issues. And (2) Communicate any concerns to each member of the Board. Frankly each candidate for the Board should be grilled on this issue at the candidate forum. And "I just don't know enough to take a position" isn';t an acceptable answer. The lawsuit papers are all public information. A candidate who is unable to articulate a settlement position is unqualified to sit on the Board (for that matter, any Board member who can't articulate their settlement position should resign).

Personally, I can choke down a settlement where the Club pays $1-2 million into a reserve fund, provided that: (1) the settlement is put to a member vote; (2) the settlement settles the issues with all 32 seawall lot owners--not just the 12 who have sued the Club; and (3) the documents are crystal clear going forward that all costs are borne 85% by the seawall lot owners and 15% by the Club (for the 17th hole of the Nick and the community dock). In short, the Club writes one check and is done.

The Board is doing "battlefield prep" for a bad settlement by bemoaning the cost and duration of the lawsuit. First, the lawsuit appears to have had no effect on the sales of river lots--let alone on community values in general. Second, the Club has made a claim under its Directors and Officers liability policy and the D&O insurer is providing a defense (actually, it may be time to sue the D&O carrier for not zealously defending the Club. Third, the portion of the Club's defense not paid for by the D& O carrier is spread over 580 members--the 12 plaintiffs are responsible for all of their legal expenses (as well as the Club's should the Club prevail--who ought to be interested in a reasonable settlement? Perhaps the plaintiffs should let the Club's owners know what they think is a "fair" settlement.

This is important and it may well be worth settling. But capitulation isn;'t settlement.